Workers' Compensation vs. Occupational Accident Coverage

With the number of workplace accidents still occurring despite our best efforts, it is essential for companies to secure the right insurance coverages. Workers’ Compensation and Occupational Accident insurance are two of the most common coverages. While they may seem similar, there are key differences between the two that every business owner should be aware of in order to stay compliant with the law and keep employees properly protected.

Workers' Compensation 101

Workers’ Compensation (Workers’ Comp) is a government-mandated program that provides your employees medical, rehabilitation, income benefits, and more if injured while on the job. It also provides some level of protection against legal action by the injured employee but is not the same as unemployment benefits or disability insurance.

One key feature of Workers’ Comp is that it is a “no-fault” system, meaning that it provides benefits to employees regardless of who was at fault for the injury or illness. This can be an important benefit for employees who are injured in accidents that may have been caused by their own actions, as they will still be eligible for benefits.

Another important feature of Workers’ Comp is that it typically has a set of specific benefits and limitations that the state’s law determines. However, the specific benefits and limitations can vary depending on the state in which the employee is based.

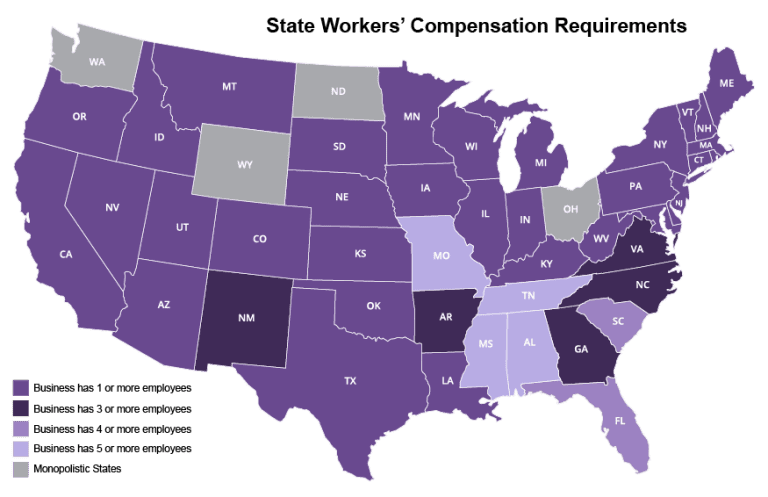

According to the law, each state has certain rules an employer must follow when it comes to Workers’ Comp. One of these rules has to do with the number of employees a business has working for them.

According to the map above, you can see which states require a company to obtain Workers’ Comp based on the number of its employees. Employers can obtain this coverage from any insurance company/agent unless the state is monopolistic. If the state is monopolistic, the employer must go through the state fund to get their coverage. If you are unsure, always check your state government’s website for more information or visit https://www.dol.gov/agencies/owcp/wc if you are unsure which site to go to.

Occupational Accident 101

- The limit of liability to carry per accident.

- The deductible to assume per accident.

- The level of liability coverage to provide.

- The level of death benefits to provide.

The Difference

Workers’ Comp provides coverage for accidents and injuries by hired employees (W-2 or company drivers) whereas Occ/Acc covers independent contractors or owner-operators (1099 employees). Both provide similar coverages, but understanding the type of employees you have can help you determine which coverage is right for your business. For example, owner-operators that are leased on a motor carrier are not considered employees but rather independent contractors.

Also, Occupational Accident Coverage is not a “no-fault” system. This means that if the employee is found to be at fault for the injury or illness, they may not be eligible for benefits. Occupational Accident Coverage may also have more limitations on coverage and benefits than Workers’ Comp.

Another key difference is that Occupational Accident Coverage is typically a more customizable insurance option than Workers’ Comp. Employers can choose the level of coverage and benefits they want to offer their employees, as well as the deductibles and other policy features.

Which One is Right for You?

- Workers’ compensation is required by law in most states, so if you have employees, you will likely need to carry workers’ compensation insurance.

- Workers’ compensation typically provides more comprehensive coverage than occupational accident coverage, but it may be more expensive.

- Occupational accident coverage may be a more affordable option for some employers, but it may not provide as much coverage as workers’ compensation.

Ultimately, the choice of which type of coverage to purchase will depend on your specific needs and circumstances. It’s important to speak with an insurance professional to help you understand your options and make an informed decision.

If you need more clarification on Workers’ Compensation coverage or Occupational Accident coverage, call Marquee Insurance Group at (833) RING-MIG.